How a CIBIL Score Calculator Helps You Understand Your Credit Standing

In today’s fast-paced financial world, understanding your credit standing is not just a choice but a necessity. One of the most effective tools to gauge this is the CIBIL Score Calculator. If you’ve ever faced the daunting task of securing a loan or even applying for a credit card, you know the significance of a CIBIL Score. But what exactly is this score, how can you calculate it, and why is it so critical?

What is a CIBIL Score?

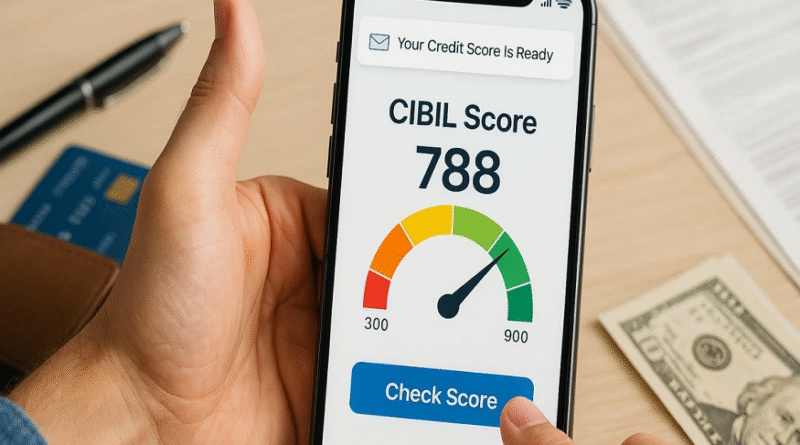

Before diving into the tool itself, it’s essential to understand what a CIBIL Score is. Simply put, it’s a three-digit number ranging from 300 to 900 that serves as a summary of your credit history and creditworthiness. CIBIL, or the Credit Information Bureau (India) Limited, is a credit rating agency that assesses financial behaviour. The higher your score, the more creditworthy you are perceived by lenders, making it easier to access loans with favourable terms.

Why Your CIBIL Score Matters

Your CIBIL Score impacts various aspects of your financial life:

- Loan Approvals: Banks and financial institutions use the CIBIL Score as a primary checkpoint when approving loans. A higher score increases your chances of getting approval.

- Interest Rates: A better score often results in lower interest rates, which can save you a significant amount of money over the life of a loan.

- Credit Limit: A solid score can also mean higher credit limits on credit cards.

In essence, a good CIBIL Score opens doors to numerous financial opportunities while a poor score can keep them firmly shut.

The Role of a CIBIL Score Calculator

The CIBIL Score Calculator is a tool designed to estimate your credit score by analysing various inputs such as your credit history, outstanding debts, and payment history. Now, you might wonder why this tool is essential when you can directly obtain your CIBIL Score from the bureau. Here’s why:

Instant Feedback

Waiting for your official score can be a lengthy process. A CIBIL Score Calculator offers immediate feedback. It helps you understand where you stand right now and what might be impacting your score negatively.

Personalised Insights

These calculators provide personalised insights based on your financial behaviour. By simulating changes, like paying off a significant portion of debt, you can see how your score might improve.

Informed Decision-Making

Armed with information from a CIBIL Score Calculator, you can make informed decisions. Whether you’re planning to apply for a loan or are strategising to improve your score, this tool is invaluable.

How is a CIBIL Score Calculated?

Understanding the elements that make up your CIBIL Score is crucial in leveraging the CIBIL Score Calculator effectively. Here’s how it’s typically broken down:

Payment History (35%)

Your track record in meeting past credit obligations forms the largest part of your score. Regular late payments or defaults can significantly drop your score.

Credit Exposure (30%)

Also known as your credit utilisation ratio, this represents the amount of credit you’re using compared to the total available. Keeping this ratio low is beneficial.

Length of Credit History (15%)

The longer the history, the better. Lenders prefer borrowers with proven credit management over time.

New Credit (10%)

Frequent new credit applications can be a red flag for lenders. It indicates potential financial instability.

Credit Mix (10%)

Diverse credit accounts, such as loans and credit cards, reflect positively on your ability to manage varied types of credit.

Using a CIBIL Score Calculator: Step-by-Step Guide

Wondering how to make the most of a CIBIL Score Calculator? Here’s a straightforward guide:

Step 1: Gather Your Financial Information

Before you begin, gather documentation related to your debts, loans, credit card balances, and repayment history. Accurate and up-to-date information will yield the best results.

Step 2: Choose a Reliable Calculator

There are numerous online tools available. Opt for ones provided by reputable financial websites or those recommended by financial experts.

Step 3: Enter the Details

Input the requisite information. Typically, you’ll need to fill in details about outstanding loans, credit card debts, and any recent changes in your credit profile.

Step 4: Analyse the Results

Once you’ve entered your details, the calculator will generate an estimated score. Carefully analyse the results and pay attention to any insights the tool provides.

Step 5: Develop a Strategy

If your estimated score is not where you’d like it to be, don’t fret. Use the insights gained to devise a strategy for improvement. This might mean consolidating debts, reducing credit card utilisation, or making timely payments.

Real-World Impact: Why This Matters

Consider this: You’re looking to buy your dream home. With property prices on the rise, securing a home loan with a good interest rate is essential. A small difference in the interest rate could mean saving lakhs over the term of the loan. Here’s where your CIBIL Score, and understanding it through a CIBIL Score Calculator, becomes critical.

Case Study: Transforming Credit Health

Let’s look at Rahul’s story. Rahul was initially denied a personal loan due to a low CIBIL Score. Using a CIBIL Score Calculator, he identified his high credit utilisation ratio as a problem area. By paying down his credit card balances and ensuring timely bill payments, he boosted his score substantially within six months. Subsequently, not only did he secure the loan, but he also received a more favourable interest rate.

Strategies to Improve Your CIBIL Score

Now that we understand the importance of regularly using a CIBIL Score Calculator, here are some strategies to improve your CIBIL Score:

Timely Payments

Set reminders or use auto-debit services to ensure all bills are paid on time. Late payments are one of the most significant negative marks on your credit score.

Lower Credit Utilisation

Aim to use less than 30% of your available credit. This shows lenders you’re not overly reliant on credit.

Avoid Frequent Hard Enquiries

Every time you apply for credit, a hard enquiry is recorded. Too many of these can negatively impact your score.

Regularly Check Your Credit Report

Mistakes in your credit report can drag your score down. Regularly review your report and dispute any inaccuracies promptly.

Conclusion: Take Charge of Your Financial Future

In a country as diverse and dynamic as India, financial literacy is key to empowering individuals. Using tools like the CIBIL Score Calculator is a proactive step in demystifying credit scores and their impact on our lives. Equip yourself with this knowledge, make informed decisions, and pave the way to your financial freedom.

By understanding and strategically managing your CIBIL Score, you not only enhance your current financial health but also secure a robust foundation for future endeavours. So, the next time you’re contemplating a financial decision, remember that your CIBIL Score is not just a number—it’s a gateway to opportunities.